Better digital media consumption research with Warbler

Warbler Media Intelligence is a data resource, adding to the suite of resources under the Flock umbrella that brought you AdHawk, to cooperatively fund better digital media consumption research. It is designed to help:

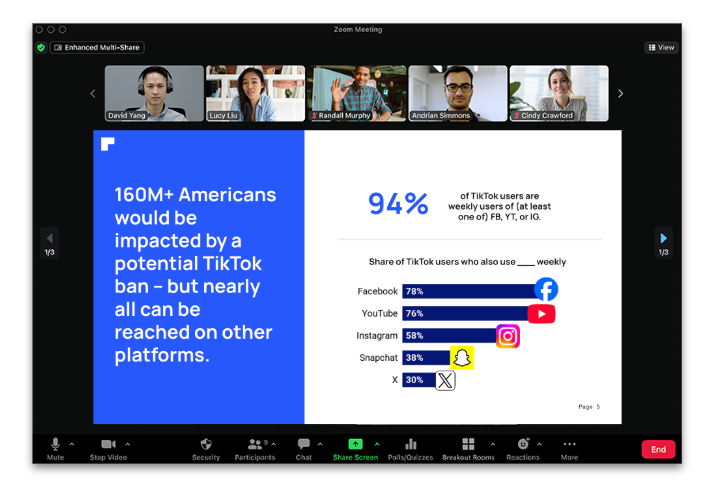

Media planners and buyers design strong campaigns with insights that reflect where their target audience is now, instead of where they were last cycle.

Campaign managers and directors evaluate and approve individual tactics as a part of a cohesive communications, advertising and digital strategy.

Social and organic managers document who is less reachable by traditional paid tactics to improve strategies to reach all parts of an audience, and map the evolution of narratives online.

Ad makers and creatives understand the format and style of content that their ads are showing up amongst and monitor what narratives their messages are contributing to or running up against.

What you get

The subscription will consist of three types of research projects and deliverables (on average per quarter):

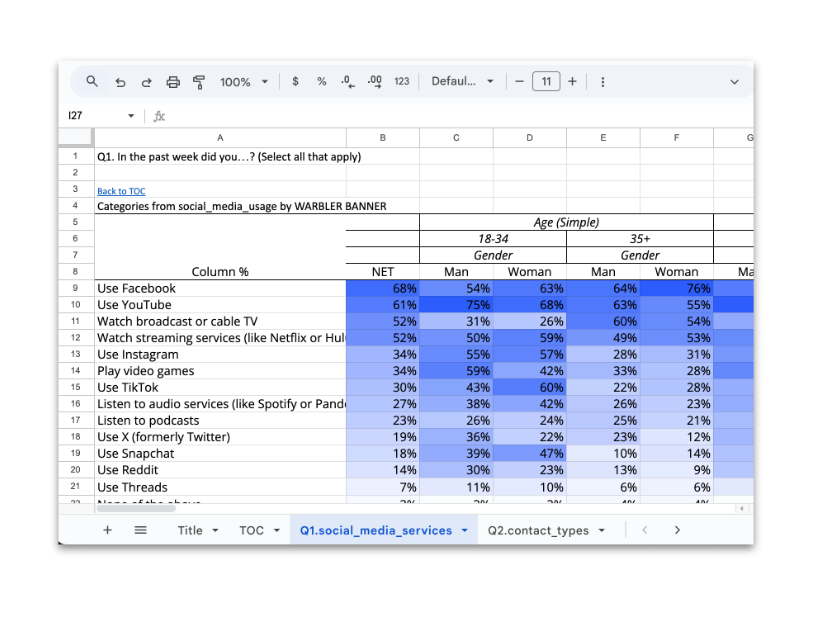

1. A large sample, multi-mode tracking survey:

Powered with enough voter interviews to enable deep crosstabs on specific audiences and detect quarter-over-quarter changes, this survey will be a mid-length questionnaire conducted via online and offline modes – ensuring we're hedging against respondents who are too online. Its primary focus will be on tracking platform reach (how many people use it) and frequency (how often and for how long), device and format, and narrative recall.

2. A platform or format deep-dive:

From YouTube to streaming and search to podcasts, this web-only, long survey will serve as a deep-dive into how users spend time on a service, what kind of content they watch, what kinds of narratives about values, issues, candidates and voting they hear there.

3. A non-survey qualitative or data acquisition research project:

We know self-reported consumption data is useful, though imperfect. Qualitative interviews can add context to attempts to quantify consumption. In the opposite direction, acquisition of observed data, like a past project collecting hundreds of voters’ Screentime reports, can help validate voters’ own stories about their habits and behaviors.

Meeting a Need

- While some media analytics resources exist, they’re not always bound by American borders, let alone registered voters or target audiences

- On the flip side, real estate in benchmark polling is so scarce that one or two questions might make it onto a survey, but not enough to guide tactical practitioners

- Cost and complexity of dedicated projects prohibit frequency and iterative learning – which digital strategists need to stay ahead of the curve

Sound cool?

Privacy Policy

Copyright 2025 Flock LLC All Rights Reserved